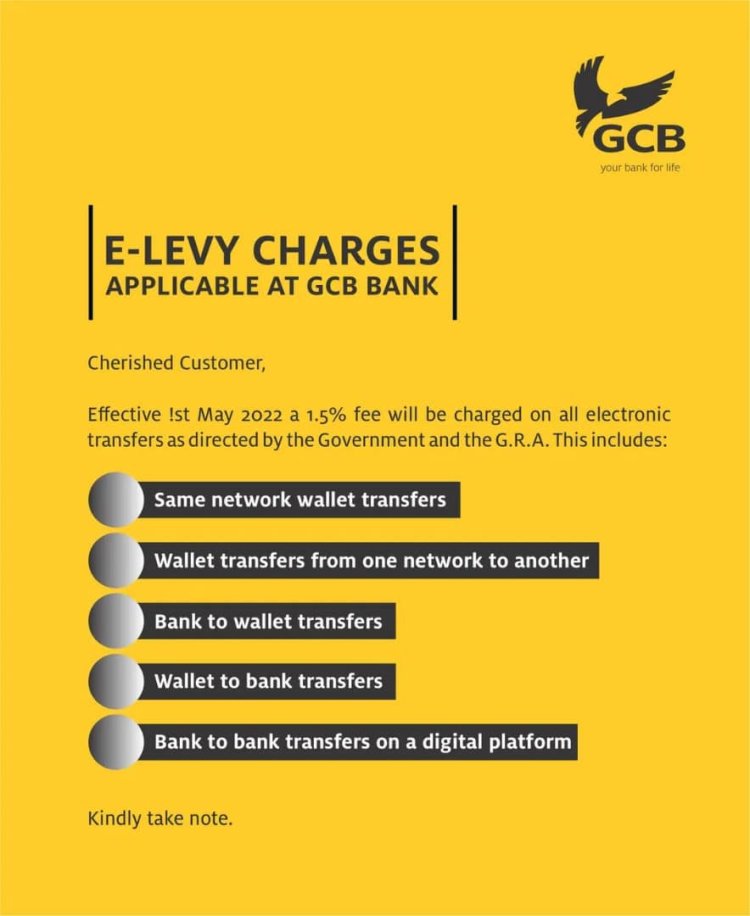

E-levy of 1.5% on electronic money transfer takes effect from 1st May, 2022.

The levy will be applied on transfers above GHS 100 daily and will be in addition to applicable charges by MTN.

All telecommunication networks and banks have informed their Valued Customers that the E-levy of 1.5% on electronic money transfer takes effect from 1st May 2022.

According to them, the levy will be applied on transfers above GHS 100 daily and will be in addition to applicable charges by MTN.

The government imposed the E-Levy on fundamental digital payments and electronic platform transactions in the 2022 Budget.

The rate would apply to daily electronic transactions exceeding $100. This differs from the proportion of mobile money transactions that telecommunication companies charge.

The E-levy Bill will be signed into law by President Akufo-Addo on March 31, 2022.

As a result, the Bill, which was enacted by Parliament on Tuesday, March 29, is now a binding law that will be implemented across the country as a revenue measure.

On Tuesday afternoon, the House of Commons passed the contentious Electronic Transactions (E-Levy) Bill.

Mobile money transactions between accounts with the same electronic money issuer, as well as mobile money transfers from one electronic money issuer to a recipient on another electronic money issuer, will be subject to the tax.

Transfers from bank accounts to mobile money accounts, as well as transfers from mobile money accounts to bank accounts, are some of the others.

However, the Minister of Finance shall decide on bank transfers made using an instant pay digital platform or application from a bank account to an individual who is subject to a daily threshold.