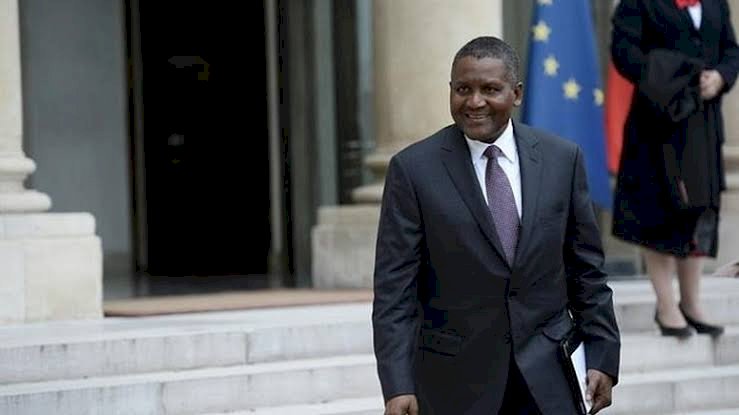

Dangote To Move Company to US Over Naira Risks

"In Africa, you know we have issues of devaluation, so we want to really preserve some of the family’s wealth,” Dangote stated.

Aliko Dangote, a serial entrepreneur and Africa’s richest man, has revealed his plans to open offices in the United States of America and London to protect his family’s wealth from naira fluctuations.

The billionaire disclosed this in an interview with Bloomberg’s David Rubenstein.

The naira has in recent years, come under pressure against the dollar as crude oil prices dip leading to fall in Nigeria’s foreign exchange earnings.

Dangote said he will use the New York base and an existing one in London to become more global after the completion of a $12 billion, 650,000 barrel-a-day refinery currently under construction.

“In Africa, you know we have issues of devaluation, so we want to really preserve some of the family’s wealth,” he said.

“We are going to start investing in the United States after this our project, we want to open a family office in New York and in London."

“We already have an office in London that has been in operation for the last 30 years so we want to turn part of that to a family office so that we can diversify the worth. Sometimes in Africa, we have issues of devaluation so we want to preserve some of the family’s worth.”

Dangote became $4.3 billion richer in 2019 with his business investments in cement, flour and sugar.

READ ALSO:

CNN Adverts: FG Must Restrict Dangote, Zenithbank, Globacom - Bode George

According to the Bloomberg Billionaires Index, the 62-year-old businessman ended the year with a net worth of almost $15 billion, making him the 96th wealthiest man in the world at the end of 2019.

Dangote holds 85.2% stake in Dangote Cement and has shares in other companies like Dangote Sugar, Nascon Allied Industries, Dangote Flour Mills and United Bank for Africa.

Dangote incorporated his own business selling cement at 21 and begun cement manufacturing in the 1990s.

He has a crude oil refinery currently valued at $12 billion oil refinery under construction